Carolyn Kissane, academic director and clinical professor at the Center for Global Affairs at New York University, leads the conversation on the geopolitics of oil.

FASKIANOS: Thank you. Welcome to the final session of the Winter/Spring 2023 CFR Academic Webinar Series. I’m Irina Faskianos, vice president of the National Program and Outreach here at CFR.

Today’s discussion is on the record. And the video and transcript will be available on our website, CFR.org/Academic, if you would like to share these materials with your colleagues or classmates. As always, CFR takes no institutional positions on matters of policy.

We are delighted to have Carolyn Kissane with us to discuss the geopolitics of oil. Dr. Kissane is the academic director of both the graduate program in global affairs and the graduate program in global security conflict and cybercrime at NYU’s Center for Global Affairs, where she is also a clinical professor. She also serves as director of the energy, climate justice, and sustainability lab in the School of Professional Studies at NYU. She was named in 2013 by Breaking Energy as one of the top ten New York women in energy, and top ten energy communicator. She’s a member of the Council on Foreign Relations and the National Committee on U.S.-China Relations, and serves on several boards.

So, Carolyn, thanks very much for doing this. We really appreciate it.

I thought we could begin by talking about how has the geopolitics of oil changed, especially vis-à-vis Russia’s war in Ukraine and OPEC’s recent announcement to cut oil production?

KISSANE: Well, first of all, I’d just like to say, thank you so very much for having me. I’m really delighted. I am a big fan of CFR’s Academic Webinars. So, to have the opportunity to participate in this—in this way is very meaningful to me. So, thank you.

So, wow. There is so much happening in this space, the geopolitics of oil. This has been a tremendous fourteen months. Russia’s reinvasion of Ukraine very much upended the geopolitics of oil because Russia is a significant producer, one of the top three in the world.

And it’s—you know, it’s caused a kind of a reshaping, a kind of a remapping of the—of oil geopolitics. And we’ve seen some, you know, shifts in how countries think about oil security, in light of larger questions about broader energy security questions. And also, on top of that, is the ongoing energy transition, coupled with, you know, climate change, and the need to decarbonize.

So, there’s just—it’s been quite a—you know, a year and a half, that has really sort of put energy security, and oil security, very much at the forefront of people’s minds.

FASKIANOS: Fantastic.

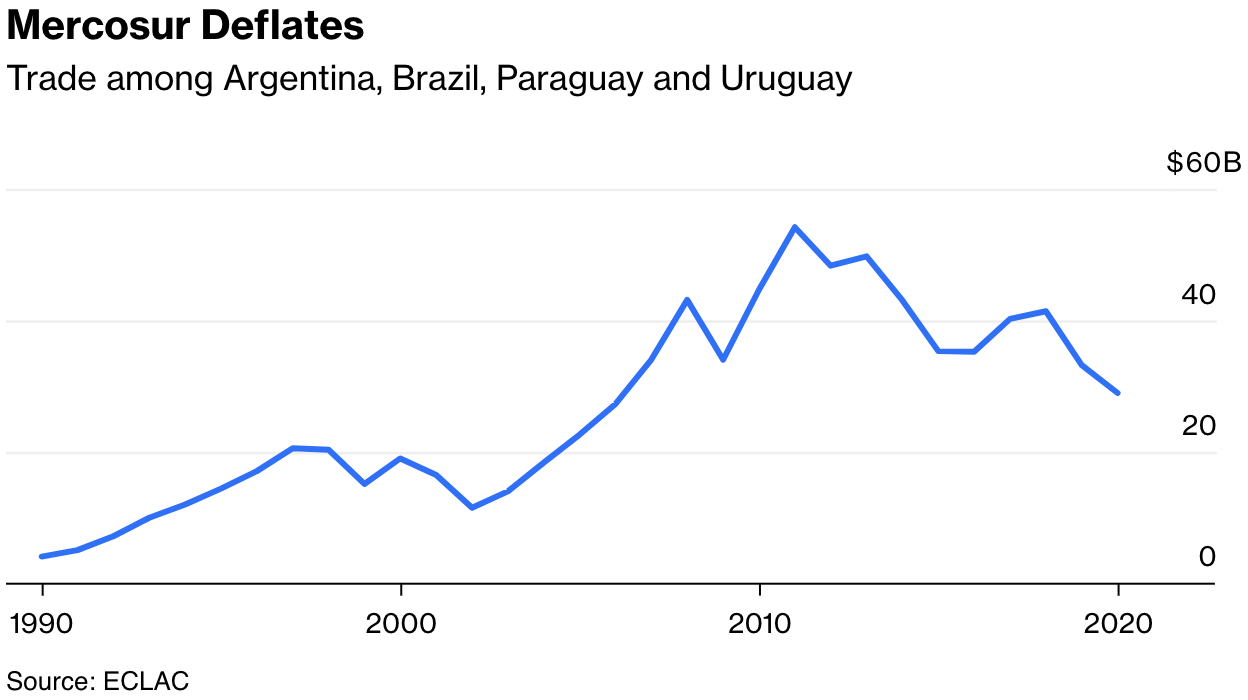

I thought maybe you had some really interesting data to show us. And if you could walk us through those—the trends you are seeing and really bring it to life, that would be fantastic.

KISSANE: Sure.

So, before I do—I have a couple of slides. And before I share my slides, I think it’s really important that, sort of, we understand how interconnected, sort of, the global energy system is, and how interconnected we are, when it comes to the flows of oil.

You know, some countries are very well resourced-endowed, so they have oil. And other countries do not, so they need to import oil. There’s really no country in the world that doesn’t need oil for larger national security issues. And I think one of things that many people sort of are not necessarily aware of or think about, is the amount of oil that gets produced every day.

So, every day, the world consumes over 100 million barrels a day. And every day, that 100 million barrels has to be—has to be moved. It has to be—you know, as part of getting it into the system, getting it to its respective destinations. And what we’re not seeing—which, maybe some people may have thought that we would see at this point—is we’re not seeing a reduction in demand, but we’re seeing an expansion in demand. And much of that global demand is coming out of Asia. And we’re also, of course, seeing the—with the reopening of China, lots of really interesting questions as to what oil demand will be in China for the 2023-2024 years, whether or not they will—they will, sort of, put extra pressure on global demand.

And you know, Irina, just also, you know, it’s—I’m going to share this in my slides. But you know, last week’s decision from OPEC+ to reduce production, of course, had an impact on the price of oil. So when the decision was announced on Sunday, by Monday morning, we saw an uptick in the price. It’s stabilized, but we are sort of looking at $80-plus-a-barrel oil. And again, lots of uncertainty as to what that’s going to mean across economies that are in recessions, experiencing sort of the beginnings of a recession, and sort of what does it mean for the global economy, where we may see sort of more energy inflation.

So, one of the things that I really like to do when I teach the geopolitics of oil is sort of show some visuals. Because I think, again, sort of, really reinforcing the interconnected nature of our global energy system, but also sort of seeing where in the world is oil produced, and where in the world are the—are the importers. And also, just a couple of sort of fun pieces on what we have seen, just this—you know, in the last week, of course, some of this—you’ll be familiar with, those in the audience—but this decision on the part of OPEC to reduce production by 1.2 million barrels a day—again, happening at a time, not when we have an excess supply, but when we’re seeing a tight supply across the oil market. So, it came as a bit of a surprise to—you know—to even the most, you know, longstanding analysts and OPEC observers.

And again, part of this is directed probably toward self-interests on the part of Saudi Arabia and the oil producers that are really going to make the cuts. But of course, it also has an impact here for those of you that are sitting in the United States. What does it mean then for prices that Americans pay at the gas pump? So, the Biden administration sort of came out after this decision was made in sort of being disappointed, surprised that OPEC would make this decision.

Now, it’s also important to sort of recognize that this is not just a singular OPEC decision. This is part of, now, a larger OPEC+. And OPEC+ does also include Russia, as well as other countries like Kazakhstan and Mexico. So, the OPEC that we have historically known is now different, because you have other countries that are not official members but nonetheless are part of what we now refer to as OPEC+.

And these are the countries that are part of OPEC, and really the country that’s considered to be sort of in the driver’s seat of OPEC is that of Saudi Arabia, because Saudi Arabia is the largest producer within the OPEC organization, producing anywhere from 10 to 11 million barrels a day. Venezuela has the largest reserves, but it is far from being at capacity, in terms of what it can—what it can produce. So, just to kind of put that into perspective, these are OPEC countries and their respective reserves.

And then non-OPEC—the United States being a non-OPEC country, but again, this sort of—this chart to the right shows, you know, again, the world is consuming a little over 100 million barrels a day, expected to increase over 2023 and into 2024, question marks as to when we may see peak oil demand.

But again, to sort of link this to energy security—energy security, especially when it’s in the context of oil security—is making sure that we have adequate supply at affordable prices. So, when we see a reduction in supply at a time of tight markets, that suggests that we’re also going to see higher prices that’s going to directly hit vulnerable economies.

And so, again, just to sort of point out sort of where in the world sort of are the top three oil producers: the United States, Saudi Arabia, and Russia. Russia remains in the top three. Canada as well, our, you know, neighbor to the north. And China is also a producer of oil. The United States figure here also includes gas liquefied, so liquid petroleum, which the United States is endowed with a lot of both oil and natural gas.

And then the top oil consuming countries, you have U.S., China, and India. Now, the United States is not the largest importer. That position is now held by China. But as far as consumption goes, we consume over 20 million barrels a day. Again, big question mark about China, in terms of whether or not we will see higher demand coming out of China over the next year, two years, with China’s reopening and what is being, you know, discussed as revenge tourism. And more Chinese who have accumulated a lot of savings, 2.1 trillion, how are they going to use that savings and whether or not, after three years of being under lockdown restrictions, whether or not we’ll see impacts to demand.

And I think Russia is—there’s lots of questions about Russia. And this is now—we’re fourteen months into, you know, Russia’s reinvasion of Ukraine—and I emphasize reinvasion, because oftentimes, we forget that, you know, Russia invaded Ukraine in 2014. But Russia is still moving its oil. And up until, you know, a few months ago, its overall production and exports were as high—at some points, even higher—than pre-invasion. Now, you have new countries that are takers of Russian oil, and they’re buying it at discounted prices. We see Turkey, Singapore, China has been a big buyer, as well as India, that they have been buying discounted Russian oil. Lots of interesting questions that we could discuss about the oil price cap and seaborne embargo to Europe. But I think the takeaway from this slide is that Russia continues to produce oil, continues to sell it, selling at a discounted price, but there are still many countries in the world that are eager to take Russian oil.

And again, I’m not going to go into this, but I just love this slide, to just emphasize the—you know, the world’s pipelines. These are the pipelines that help sort of the transit of oil. Something also that’s really unique and interesting to look at is just tanker traffic, so, the tankers that carry oil around the world. But again, you know, there are a lot of pipelines, so twenty-three—two thousand, three hundred, and eighty-one operational oil and gas pipelines. Again, these are—it’s moving a lot of the oil that is consumed every day.

And then finally, is this—is—you know, one of the things that we oftentimes—we think about the hundred million barrels a day that the world is consuming, over 75 percent of the world’s oil is controlled, managed by state-owned oil companies. So, Saudi Aramco being one, PDVSA of Venezuela being another. But it’s really important to sort of recognize the position that state-owned companies have. The rest is controlled or managed by international oil companies—ExxonMobil, Chevron, ENI, Total, and a host of other—host of other companies.

But again, I think the—you know, to understand that NOCs, as they’re referred to, are very, very important for understanding their role in the larger context of the geopolitics of oil.

And again, what we saw last week coming out of OPEC, this decision, this is also being driven by state budget concerns. This is—again, it’s about the production of oil, but it’s also about, you know, governments and their budgets. And oftentimes, you know, there is a desire to add more, rather than—you know, more revenues rather than less.

So, those are the slides that I have. And I hope that they sort of provide some sort of context, and a little bit of, you know, that we can discuss in the questions that I really look forward to answering from the audience.

FASKIANOS: Thank you, Carolyn. That was great.

So now, we’re going to go to all of you for your questions and comments.

(Gives queuing instructions.)

All right, so I’m going to go to the first raised hand in the thing. Amadine Hom, go to you first, and please accept the—unmute yourself.

(Pause.)

You are still muted.

(Pause.)

OK, I don’t know—are you there? Oh, I think—OK.

Let’s go to Morton Holbrook.

Q: Yes, good afternoon.

Dr. Kissane, what a shocking presentation—(laughs)—a hundred million barrels a day and it’s going up, notwithstanding the Paris Climate Agreement of 2015. Is that agreement simply a dead letter, or is it having any effect on oil—on fossil fuel production, particularly oil production? Or what’s the best scenario, in terms of reducing dependence on fossil fuels, considering the oil market?

Thank you.

KISSANE: Well—hi, Morton, thank you so much for that excellent question.

Yeah, that’s kind of why I emphasize that number, is because a lot of people sort of just aren’t aware of how much oil we continue to consume, and again, what the demand expectations are moving forward. And these demand expectations are, you know, coming out of forecasts from the International Energy Agency.

So, I think there’s a big question as to when we see peak demand. And, you know, if you look at BP scenarios, they expect peak demand to happen, you know, before 2030, where, as, you know, others kind of contest that they—that they think that peak demand won’t happen until after 2030. I mean, again, a lot depends on, you know, what we are now experiencing in the energy transition, and how, sort of quickly are we—can we transition away from oil.

I think what’s really critical, when we’re looking at oil, is oftentimes we think only about the transportation sector. So we’re thinking about cars, we’re thinking about planes, you know, we’re thinking about trucks, and tankers, and all these things. But it’s petrochemicals, you know? There’s just a lot of oil that also goes into fertilizer. So, it really is across our economy, and across economies, across the global system.

One of the things that I always tell my students is even during COVID, where you had many countries, right, much of the world was experiencing some level of lockdown, we did have a reduction in oil demand, but it wasn’t—it wasn’t like 20 million barrels. It was under ten.

So, the fact that now it’s 2023, the world has reopened, it’s really hard to sort of see, or to know with certainty, is when we’re going to see that—see that reduction in demand.

Now, I think with the Paris Agreement, what’s also important is—to note is, you know, if you’re—if you’re in the oil and gas space—and I was just at a conference earlier this morning where this was a point of conversation—was, you know, what are the companies doing to reduce the emissions from production? So, how are they integrating carbon capture, sequestration, you know, how are they managing the emissions that come from the production of fossil energy—in this case that we’re talking about, oil.

And I think one of the things that—I think if you sort of follow oil markets, or a country like Saudi Arabia, they are marketing low-emission oil. Now, we could—you know, we could sort of challenge, well, what does that—you know, what does that really mean? But you are having, you know, countries that are now sort of competing to state that they have lower emitting carbon in the production—in the production of oil. And that’s a whole other interesting sort of thing to look at, in the context of the geopolitics of oil, is to kind of understand the variation across emissions, across different countries, in the production of oil.

So, we are—you know, again, we are going to be going into COP-28 this fall. Again, we are not seeing—you know, and we haven’t seen a, you know, reduction in fossil energy demand. Again, lots of people are sort of, you know, hoping that we’ll start to see it sooner rather than later. But for the time being—and again, you know, to Irina’s first question, that, you know, the last fourteen months, and with, you know, with Russia’s invasion of Ukraine, it has both shown us that, you know, Europe is sort of seeking to hasten the energy transition, by building out more renewable energy, and creating more opportunities to buy electric vehicles.

But there’s still big swaths of the world that, you know, are still, and have yet to move towards, you know, really reducing—and that are actually going to see higher demand moving forward, as their economies grow.

FASKIANOS: Thank you.

I’m going to take the next question from Jovana Vujanic, who is a graduate student at Lewis University: How big of an—of an impact will the decision of the Saudi energy minister to cut oil production have on the relationship between the United States and Saudi Arabia?

KISSANE: Love the question, thank you so much. Yeah, no, it’s a great one.

So, my take is that, of course, this decision came as a bit of a surprise, and it wasn’t something that the United States, you know, wanted. But I would say that the U.S.-Saudi relationship has been very tense for the last ten years. And as part of that—there are lots of different reasons for that, but this is yet—kind of another thing that Saudi has done.

And again, I think it’s also—Saudi has taken a non-alignment policy with relation to its position on Russia and Ukraine. So, it continues to—you know, it continues to have a relationship with Russia. It also has the relationship with Ukraine. As we saw, you know, China just brokered a very significant deal between Saudi Arabia and Iran. You know, again, Saudi Arabia and Iran are two—are two important producers for China. So, China is a large importer of oil.

So, if you go back to World War—the end of World War II, that’s when the United States established the oil-for-security relationship with Saudi Arabia. And as we have grown, sort of, more—I wouldn’t say independent, but our—as our own oil production has increased, especially through the shale revolution, our dependence on the Middle East and Saudi Arabia, more specifically, has shifted.

So, I think we’re seeing a very different Saudi Arabia today, which I think is going to be a challenge for the United States. I think it’s going to be very interesting to see what the summer holds. Last summer, the Biden administration did tap into the U.S. strategic petroleum reserves, the largest—the largest take in the history of the reserves, which started in 1975, you know, taking 180 million barrels out, you know, not because there was massive supply disruptions. But because, you know, as the administration said, it was—you know, it was—it was—it was a war—it was a war-specific decision, because the—you know, Russia’s invasion of Ukraine was causing energy prices to skyrocket. And to cushion the American consumer, and to better cushion the, sort of, the global economy, the United States withdrew from the SPR. So I think the summer is going to be very interesting.

But I think we’re going to see, definitely, much more attention in the years to come, between the United States and Saudi Arabia. It’s not the relationship of the past. This is a kind of a very new relationship.

That’s a great question.

FASKIANOS: Thank you. Thank you, let’s go Curran Flynn, who has a raised hand.

Q: Hello?

FASKIANOS: We can hear you, but we’re getting feedback. So you might have two devices open.

Q: Can you hear me now?

FASKIANOS: Yes.

Q: That’s better. OK.

FASKIANOS: That’s better. Thank you. Thank you so much.

Q: So, I’m here at King Fahd University in Saudi Arabia, right next to Aramco, here with my class from international relations. And one of my students has a question, Nasser al-Nasir (ph). Here he is.

Q: So, thank you, Mrs. Carolyn.

My question is: How could Russia’s use of alternative transportation methods, such as the East Siberian Pipeline to China, impact the U.S. market, the domestic market, and the role of the SPR, given potential insurance workarounds from Russia’s side such as ensuring Russian tankers through their RDIF fund?

And thank you to Mrs. Irina.

KISSANE: Thank you. And, Dr. Flynn, thank you so much for having your students join this webinar.

So, I’m a little—so, the question is about the East Siberian Pipeline? Just could you—would you mind repeating it? I just want to make sure I have it—I’m clear on the question.

Q: So, how could Russia’s use of alternative transportation methods, such as the East Siberian Pipeline to China, impact the U.S. energy markets, I mean domestically, and the SPR, given potential insurance workarounds from Russia’s side such as ensuring Russian tankers to the RDIF fund?

KISSANE: Yeah, and that’s a great question.

You know, I think that, you know, begs a lot of things that we could be looking at, right, in terms of, you know, Russia’s kind of ability or capacity to sort of work around, or find workarounds, to the sanctions that were imposed. And I think we’ve seen sort of new markets—so, this kind of reshaping of the energy map with oil, we see that as—kind of in technicolor, right, whereas, you know, a lot of Russian oil would go west, is now going east, you know, China, India, being takers, and of course, you know, other countries as well.

You know, what will be its impact on the—on the U.S. market? I think that’s—you know, again, I do think the sanctions were sort of carefully put into place, so that there wouldn’t be massive disruptions, so we—again, you know, Russia produces over 10 million barrels a day, and about 7 million of those barrels are exported. So, you know, if we lost all of that, that would be a—you know, that would cause some very significant economic disruption globally. We already saw, you know, impacts to sort of grains, grain exports, and food security in many different parts of the world.

So, you know, Russia is finding different ways. You have shadow tankers that Russia is using to move—to move its oil—as you pointed out, the East Siberian pipeline. You know, I think there’s only so much the United States can do, or—and European countries that are part of the sanctions regime, can do to curtail Russian exports of oil.

But I think that—you know, I think Russia, again, has a—has a desire, and also, you know, revenue needs—they’re funding a very expensive war—that they’re finding ways to get their—to get their oil out. I think an interesting question is, you know, what does this mean in the years ahead, the lack of investment, for example, that’s going into Russian energy infrastructure, a lack of, sort of, any kind of Western investment that is—that is going in, and what that is going to mean.

But again, you know, I think, to your question, I think we will see some—you know, we are seeing some impacts, right? There’s a big question as to what—you know, what the next six months to a year will look like, with regards to the reduction from OPEC, and if we were to see a deeper curtailment on Russian oil.

And you know, would the United States then tap more into the SPR? We’re now at—you know, we’re down to seven hundred thousand barrels, which, of course, is not insignificant. But we also sort of have to be, you know, judicious about how we use the SPR.

But thank you for the question.

FASKIANOS: Thank you.

I’m going to take the next question from Michael—let’s see— Trevett, a Ph.D. candidate at the University of Southern Mississippi: China and other countries claim there are petroleum reserves under the South China Sea. What are your estimates of the potential amount there, and has China begun to extract any of this oil?

KISSANE: Michael, thank you so much. That’s a great question.

So, China already is an oil producing country, so you do have oil production in China. In the South China Sea, I can’t—I can’t say exactly. I know that there have been geological tests that have shown the reserves. Again, you do have—you know, you do have territorial concerns about sort of where—is this—you know, can China—can China tap those—or seek to explore and tap those reserves, again, if there are—if there is contention over the territory in which these reserves are located?

So you know, China, again—one of the things that’s very interesting about China is that China is an oil producer, but China has seen, over the last, you know, the last decade, they have seen that they have experienced peak demand. So—I mean, sorry. Peak supply. So, they are not producing as much as they used to. And so you’re seeing a year-on-year reduction in the producing capacity.

You know, if you go back maybe five or six years ago, there was lots of questions about if China could kind of replicate what happened in the United States around the shale oil revolution. I think one of the big challenges for China is that, of the—you know, where the shale reserves are located, it’s not near water, lots of questions as to—and some of it—basically, some of the tests have shown that it’s—it definitely is proving harder that, you know, they cannot sort of model the same level of development that we have seen in the United States.

So, yeah, no, I think in the South China Sea, again, I think we—it’s potentially possible that we might see it. I wouldn’t—I wouldn’t—I wouldn’t say it’s soon.

FASKIANOS: Thank you.

I’m taking the next question from Rob Warren at the Anglo-American University of Prague. This question also got an upvote: How do you foresee Venezuela’s role in the global oil market changing moving forward? And can it be reintegrated into the global economy?

KISSANE: Oh, these are all fantastic questions. Thank you all so much.

Yeah, Venezuela is—again, you know, Venezuela has—they have the largest reserves in the world. As part of this webinar, right, you—CFR had a—kind of a primer on Venezuelan, and kind of—you know, you look at sort of where Venezuela is. And one of the biggest challenges confronting Venezuela is both its politics, but it’s also—it basically—you know, you don’t have—you don’t have international oil service providers in the country. I think the only—the only one now that the U.S.—the U.S. has sort of given a sanctions exemption to, is that of Chevron.

But I think—yeah, I mean, if you were to see, you know, kind of shifts in the political regime, and you were to see more openness, then I think you could imagine, you know, Venezuela having an opportunity, or a pathway forward, to be more integrated into the global energy system, and the global oil system. You know, I think one of the big problems that Venezuela faces is that most of its infrastructure is really old at this point. And it would need a significant amount of reinvestment to get it up to a place that it could sort of meet its potential.

So, you know, Venezuela is one of these countries that’s not producing as much as it could, right? It has the potential to be producing 2 million-plus more barrels per day. But you know, we’ve seen that they really have just—they went into freefall. So, I think that’s a big issue.

And another big issue, which—God, it goes back to an earlier question—is that of emissions. So, the oil that comes out of Venezuela is a very, very heavy oil. So, it’s—it has very large carbon emissions associated with the production of that oil. So, that, I think, is—again, as we—you know, think about the emissions from oil production in countries that are sort of seeking to kind of market themselves as low-emission producers, you know, Venezuela definitely will have a very hard time recouping its—where its oil sector was. Again, it has the capacity, it has the reserves. But getting that—getting that oil out of the ground right now, you have a lot of significant above-ground risks.

FASKIANOS: Thank you.

I’m going to go next to Clemente Abrokwaa. Raised hand, so please unmute yourself.

Q: Can you hear me, please?

FASKIANOS: Yes, we can.

Q: Thank you. Thank you so much for your—for your talk. I was also very shocked about the amount of barrels that we consume every day. (Laughs.) I didn’t know that. But anyway, I’m from Penn State University.

And my question is: You just mentioned about the above-ground, you know, effects. And—so the movement towards, like, electric vehicles and so on, how do you think it is going to affect the African continent?

KISSANE: Thank you.

Q: I am—I’m thinking, you know, the economies, and then infrastructure. It will be very difficult for them to—(laughs)—move with the rest of the world in terms of electric vehicles, and so on. I just wanted your take on that.

KISSANE: Thank you, Clemente. It’s an excellent question.

Yeah, I mean, you have countries across the African continent that not only have oil reserves, but are already producing, right? Nigeria is a—is an oil-producing country, also has more capacity, but again, you have some above-ground risks. You also have the need for investment of new infrastructure.

I think one of the things that has been very interesting—and I think it’s getting—it’s getting more attention, as it deserves, is how Western governments are—some of—I think a challenge across Africa is that a lot of Western governments have sort of said, listen, we’re not going to invest in fossil fuels—or also, financial institutions, Western financial institutions—we’re not going to invest in fossil fuels, or new projects that are fossil-based.

And that—you know, that’s problematic when you look across the African continent, where you still don’t have, you know, 100 percent energy access. You know, the idea of the transition to electric vehicles, which is taking a very, very long time, even here across the—across developed economies—so the need for the infusion of more capital to go into, you know, across the continent of Africa for oil and gas, that’s for their economies and for their own economic growth, I think, is really, really pivotal.

And I think this is something that, you know, is being discussed across multilateral financial institutions. And also, you know, is it hypocrisy, right, for Western banks that have, you know, kind of funded the oil and gas industry, or helped to fund the oil and gas industry in the United States and many different parts of the world, and that are now sort of not allowing those funds to flow to Africa. And they have the—again, they have the—they have the resources. So you know, is it—you know, the equity of some of these decisions that are being made, I think, is one that’s—is one that’s really important.

And again, I—you know, I said earlier in this talk, is that, you know, all—most of the demand for oil is not coming from North America and from Europe. All of the demand that we’re seeing and new demand that we’re going to see, is coming from Asia, and is going to come from Africa.

So again, you know, how are we going to make sure that that demand is met, again, going back to that idea of energy security, so there is—there is accessibility, so there is reliable sources of energy at affordable prices, you know, without sort of thinking about kind of a whole-of-energy approach.

So, I think it’s very—it’s a very complex issue. And I think, you know, Western banks who have sort of taken very sharp positions on what they will and will not fund, when it comes to new oil and gas projects, are getting sort of challenged as to, you know, what does that mean, then, for, you know, countries across Africa that are still very much in need of more energy, not less. And again, recognizing that, you know, EVs that, again, are still—are—you know, we’re seeing adoption here in the United States and across Europe, but it’s a big, big, big adoption in China. But it’s very uneven. So how do we ensure greater energy security for the continent of Africa, I think, is a really critical question.

FASKIANOS: Thank you.

I’ll take the next question from Kyle Bales, who is a senior at Lewis University in Romeoville, Illinois: How is the war between Russia and Ukraine having an effect on the progress of the European Green Deal? Maybe you can tell us what the European—define the European Green Deal for us, Carolyn, give us the context for that.

KISSANE: Yes, so, again, this is another fantastic question.

Yeah, the European Green Deal, it’s—this is—this is great. Yeah, I mean, a lot of people would say that the European Green Deal now is—that the—Russia’s invasion of Ukraine has sort of said, hey, this is why the Green Deal is so important. This is why we really need to more quickly transition to renewable energy, because look what—look what happened when we were dependent on Russia for over 30 percent of our natural gas. And look, when Russia, you know, illegally invades Ukraine and suddenly weaponizes gas, we are left very energy-insecure. It affects—it affects consumers. It affects industry across the continent.

So, I think we’re seeing, not just through the Green Deal, but we’re also seeing through, sort of European green industrial policy—so in some ways, akin to what, you know, we put into effect in—this past summer, is the Inflation Reduction Act. And we’re seeing almost, kind of, this industrial competition around clean energy technologies.

And so, Europe is investing—you know, I think it’s about $250 billion, the United States, it’s about 370 billion—towards the—kind of the energy transition, and helping to support domestic industries and companies to—you know, to be able to, you know, develop the technologies, and to have the, you know, the opportunity to contribute to the energy transition.

So, I think one thing, though—whenever I talk about Europe, it’s really important, is to sort of recognize that, you know, when you look across Europe, you have very different policies and kind of approaches, to sort of thinking about energy, and how quickly some countries want to transition and can transition, whereas others, you know, are probably going to experience a slower transition.

So, just really interesting example, as you talked about the Green Deal, is the EU taxonomy, the green taxonomy, that went into effect in the—January of 2022. And there, you had, like, really a lot of contention between France and Germany, because France wanted to make sure that nuclear was part of the green taxonomy. Germany was opposed, right, but Germany wanted to make sure natural gas was part of the green taxonomy. So ultimately, in the end, both natural gas and nuclear—and again, this was—this predated Russia’s invasion of Ukraine. But in the EU green taxonomy, you have—you know, you have both nuclear and natural gas, in addition to other renewable energies that can make up this taxonomy, that includes specific measures towards adaptation and mitigation for climate change.

So you know, I think you’re seeing this kind of—some people call it a race, a competition. You know, ideally, it’s—you know, we’re kind of working together to—because we’re all sort of going in the same direction—to, you know, support the transition, and to reduce—to reduce carbon emissions, and to bring in more, sort of, cleaner energy technologies into our system.

FASKIANOS: Thank you.

I’m going to take the next question from Dr. Laeed Zaghlami.

Q: Yes, good afternoon. This is Laeed—good afternoon, Irina. Good afternoon, Carolyn. I’m very pleased to be part of your program.

Just to—want to be back to Africa and particularly to Nigeria, how practical the two projects that Nigeria is advocating for pipelines, one from—through Algeria, and the other one to Morocco through western African countries? How practical are these pipelines to supply gas to Europe and parts of some African countries?

FASKIANOS: And Dr. Zaghlami, you are at Algiers University, correct?

Q: Indeed, Irina, yes. I am professor at University of Algiers, faculty of information and communication.

FASKIANOS: Thank you.

KISSANE: Dr. Laeed, can I—can I keep you on for just one second?

Can I ask you, what is the—what is the status right now? Is it—it’s planned, under construction? Where is—what is the status of those two pipelines? My understanding is that it’s—they’re proposed, but—

Q: Yes, well, actually in—practically, the pipeline between Algeria and Abuja, which means through Niger and so forth, is already in progress, whereas the other project, through thirteen western African countries, they are supposed to be implemented by 2047. But is it—is there any political game or something of strategic—(inaudible)—how practical, how logical, how efficiently will be for Nigeria to have two similar project(s)?

KISSANE: Yeah, no, it’s—again, thank you for the question. You know, pipelines, again, that’s why I wanted to show the—(laughs)—kind of the map of pipelines, is because, you know, a lot of pipelines transverse, you know, multiple countries, right? And this is—this requires not just, you know, a lot of cooperation, but it requires technically. It also can be very complex to build—to build pipelines. And when you’re talking about something like, as you—as you point out, these are, you know, crossing many countries.

You know, I think one of the—again, one of the issues is whether or not—since, you know, what already is under construction, I think you can, you know, with confidence, that one will be completed. Anything that’s not yet under construction—and again, the timeline, 2047, is way out there—a lot of—a lot of uncertainty as to what the status of those projects will be moving forward, for various reasons, in terms of making sure that the investments are there.

Someone I know that studies pipelines, he says, you know, until the steel is in the ground, you don’t have the pipeline, and so until you know that you’ve got that, you know, you’ve got all the OKs, and you feel that kind of security of being able to build it, and being able to provide the resources to supply it and to move it.

I think Algeria has been a really interesting case that hasn’t gotten enough attention, in terms of Algerian gas, that has—that has helped support Europe. Over the last years, we’ve seen an increase in Algerian gas going into Europe. Again, a lot of attention on U.S. LNG and the increase of liquefied natural gas exports into Europe, but also Algeria has been, you know, very important for helping to support European energy security, and make up for some of the losses of the—of the Russian gas. And I think we’ll see more attention on Algeria, and Algeria’s role as a—you know, as an important source of energy, especially, you know, gas, going into—going into Europe, moving forward.

FASKIANOS: So, I’ll take the next written question from Vincent Brooks, who is at Harvard and Diamondback Energy board of directors: How do you view the purchasing of discounted Russian oil by India, in particular relative to the purchasing by China? How are they using the oil purchased? And are you seeing more internal usage or external profit-making sales in places like Africa? And what are the implications of all of this?

KISSANE: Right, great. Great question. So, all of the above—(laughs)—in some ways, right? There is definitely sort of profits that are being made.

You know, I was—I was talking about this last week with someone, and you know, if you sort of put your shoe—put yourself in the shoes of India, right, so, India is a—is a rapidly growing economy, 1.4 billion. You know, if you had—if you have very high energy inflation and high oil prices, that’s going to have ripples effects across the Indian economy. And so, you know, when you have a kind of opportunity to buy, you know, pretty steep discounted oil, which, you know, they had been able to buy from Russia, you know, for purposes of national security, they’ve been buying the oil.

And one of the things that’s very interesting about India is that, actually, India has been building out its refining capacity. So, a lot of that oil is both for domestic, and some of it is being sort of re-exported. But I think what we’ve seen is that they’re using that oil to also sort of enhance their capacity and capabilities as a rapidly emerging, refining power in Asia.

And we see that in some ways in China, too. So, China, even though oil demand was down in 2022, much of the oil that they were buying from Russia went into its strategic supplies, which, you know, they now have access to.

And again, I think, you know, a big question is what we’re going to see moving forward around oil demand in China. Wood Mackenzie just published a really interesting piece, kind of very bullish, on the expectations for oil demand in China, so whether or not they’re going to continue to buy, you know, Russian oil—and again, sort of taking advantage of these lower prices, you know. And I think—I think one of the things that—it’s kind of an inconvenient truth, whereas a lot of this oil trading used to happen in Europe, so European trading houses were kind of the main—the main points of Russian oil trade. A lot of that has been moved out, so, you know, Russia has found ways to kind of bypass some of the sanctions, and have set up—in some cases, they’ve set up trading houses. And some of those trading houses have been sort of set up in places that, you know, that they can sort of, again, bypass the compliance to the sanctions.

And you have some—you have some Russian oil traders that are making a lot of money—(laughs)—selling discounted oil, and then reselling it.

A really interesting case, a couple of months ago, was out of Malaysia. Malaysia announced—or, in the, you know—that they were—that 1.5 million barrels were produced and sold, but only—Malaysia doesn’t produce that much. So, those were Russian barrels that were sort of being sold under, sort of, the Malaysian—under the Malaysian barrel.

So, again, I think China and India have, you know, have taken advantage. Some of this has, again—as I said, has been re-exported. And some of it, you know, has been re-exported through petroleum products, because China and India, you know, both are building and have refining capacity.

FASKIANOS: Thank you.

I’m going to take the next question from Bhakti Mirchandani at Columbia University: What global trajectory do you see for nuclear? The Russia-Ukraine crisis has taken some of the refining capacity offline, and nuclear has the potential to change the geopolitics of energy. And so what steps can be taken to foster nuclear energy?

KISSANE: Bhakti, thank you. And I was just at Columbia earlier today for the Center for Global Energy Policy’s conference.

Yeah, nuclear is very interesting, right? So when we’re thinking about, you know, decarbonizing our energy systems, you know, nuclear plays a very important role, because it’s zero-emitting. So in certain parts of the world—China being one, Saudi Arabia—you know, you have a lot of new nuclear build. You know, in other parts of the world, you have a lot of contention about nuclear. We saw that even in Germany, which have, you know, three remaining nuclear power plants. And even in the midst of massive energy crisis over the last year, there was still sort of pushback about, no, those nuclear power plants need to be shut down, whereas you would think, OK, in light of energy insecurity, let’s keep them open.

So, you know, France is an interesting country. France had planned to reduce its nuclear capacity by 50 percent. But this past year, they pivoted and they’ve said, no, we’re actually going to build out more nuclear, and we’re sort of—we’re totally scrapping that idea of reducing nuclear energy. And nuclear is very important for France’s electricity system.

Sweden has also announced that they are going to build new nuclear, and they’re going to increase by, I think, almost 50 percent. Again, part of this is their—to meet their targets of net zero.

We also see Japan. Japan, you know, the Fukushima disaster really turned Japanese—the Japanese public off of nuclear. Very, very deep opposition to restarting the nuclear power plants. But this past year, even though there’s still safety concerns on the part of the public, the public is also very concerned about energy insecurity and higher prices. So, nuclear being a domestic source of energy.

So, I think when you look at, you know, net-zero pathways, I have not seen a net-zero pathway that does not include nuclear. So, here in the United States, the net-zero America project out of Princeton, very important place for nuclear. We just have a really hard time—(laughs)—building nuclear at cost, so it’s very expensive. Usually, it’s significant cost overruns. And of course, there is the—I think they have a really significant PR problem. People—there’s still a lot of concern about the safety of nuclear.

So, I think to your point, it’s very, very important for decarbonizing energy systems, but you’re going to see, I think, very disjointed approaches. Some countries are going—are embracing nuclear, and other countries are sort of doubling down on their opposition, and are not going to allow nuclear to be part of the energy system.

FASKIANOS: We have so many questions, and we are just not going to get to them all.

So, I’m going to take the next question from Christian Bonfili, who’s at Torcuato di Tella University in Argentina.

So, do you think, Carolyn, that the landscape resulting from the Ukraine invasion by Russia, vis-à-vis securitization of gas and energy between Europe and Russia, could accelerate energy transition toward greener energy?

KISSANE: Great question.

I think in Europe, it is. And I think, you know, many analysts would agree that—the IEA, for example—you know, you had the, you know—how does Europe continue—you know, to enhance and achieve energy security without the dependence on Russia gas? And a lot of that is through renewable energy. You also have a lot of new attention on hydrogen, and the role that hydrogen will play.

I think—I think Europe is being cautious, and so they are not saying that they are going to completely move away from gas, so as earlier questions, are they getting gas from Algeria, or are they getting gas from Norway? Are they getting more gas from the United States in the form of liquefied natural gas? And then also an uncomfortable truth is they continue to get liquefied natural gas from Russia. So, we’ve seen an increase in LNG from Russia going into Europe.

That said, I think all in, you are seeing that, you know, countries across Europe are saying, OK, you know, how can we enhance our energy security? How do we build more sort of domestic energy sources? Solar, wind, we’re seeing, you know, more rapid deployment. You’ve got a lot of questions about supply chains and things like that, but I think—overall, I think the answer would be that it’s quickening the energy transition.

FASKIANOS: So, I will take the moderator prerogative to just ask the final question for you to close on. And just to give us your top three—what are the major challenges for the geopolitics of oil, as you look out over the next five- to ten-year horizon, that you would leave us with, to be looking for?

KISSANE: OK. You know, so I think what we saw, right, tensions between Saudi Arabia and the United States. We also have a, you know, a hot war, cold war, depending on, you know, the term you want to use, between the United States and China, and lots of sort of questions as to what that’s going to look like.

I think there’s—you know, I think there’s concern that, you know, we’re not reducing demands, but we’re seeing tightening supply. And so that’s going to have, you know, very significant impacts for economies, especially economies that are already very fragile, economically fragile, politically fragile. So that concerns me a lot, in terms of, you know, what happens when, you know, economies don’t have adequate access to energy to make sure that their industries, that their—that consumers, you know, are able—that the lights can stay on, and you can get—you know, if you’re dependent on cars, you’re depending on trucks, like, all these kinds of things are really, really critical.

So, I think we have to be very cautious moving forward, that we don’t take more out of the system before we have adequately set up the system to be resilient, and to be able to sort of meet the energy security demands that are not—are not—they’re not decreasing. I think they are increasing and becoming even more complex.

So, I think there’s a lot of concerns and a lot of uncertainty. And you know, this definitely is going to be an area to watch in the years ahead.

FASKIANOS: Carolyn Kissane—Kissane, excuse me—thank you very much for shaping and sharing this discussion, for sharing your terrific insights with us, and to all of you for your questions and comments. I’m really sorry that we could not get to them all. But we only have an hour. (Laughs.)

KISSANE: Thank you.

FASKIANOS: You can follow Carolyn on Twitter at @carolynkissane, and we will be announcing the fall Academic Webinar lineup in the CFR Academic Bulletin. If you’ve not already subscribed, you can email us to subscribe. Send us an email,

[email protected].

Again, I encourage you to share with your students our CFR paid internships announcement. We also have fellowships for professors. You and they can go to CFR.org/careers, follow us at @CFR_Academic, and visit CFR.org, ForeignAffairs.com, and ThinkGlobalHealth.org for research and analysis on global issues.

Thank you all again. Good luck with your finals. Carolyn Kissane, thank you so much.

KISSANE: Thank you. It was a pleasure. Great.

FASKIANOS: And we look forward to your continued participation in this series.

KISSANE: Thank you very much. Appreciate everyone’s questions. Bye.

(END)

Online Store

Online Store